This page is designed to help you understand PTINs and the IRS requirement to have one and renew it each year, as well as the IRS Voluntary Education Program.

PTIN Regulations

The IRS Annual Filing Season Program is designed to encourage unenrolled preparers to voluntarily increase their tax knowledge by taking tax related continuing education (CE) courses each year. Tax preparers who choose to participate can receive a Record of Completion from the IRS. To do this, the preparer must complete the required number of continuing education hours, have an active PTIN, and consent to adhere to specific obligations under Circular 230.

Continuing Education Requirements for PTIN

All continuing education courses must be taken from an IRS approved CE provider and completed by the end of each calendar year.

There are different requirements depending on whether or not an unenrolled tax return preparer is considered an exempt or non-exempt preparer.

Non-Exempt Tax Return Preparer Requirements

Unless an unenrolled tax return preparer meets one of the requirements to be exempt, they are considered non-exempt. If they are non-exempt, they must meet the following requirements each year:

PTIN Education Requirements – Non-Exempt Tax Return Preparers

- Complete a total of 18 hours of continuing education which must include:

- A six (6) hour Annual Federal Tax Refresher course that covers filing season issues and tax law updates. This course must include taking and passing a knowledge-based comprehension test administered at the end of the course by the CE provider.

- Seven (7) hours of other federal tax law topics

- Two (2) hours of ethics

- Renew (or obtain) their PTIN

- Consent to adhere to specific practice obligations outlined in Circular 230, Section 10.51

Tax preparers who have completed one or more of the following are considered exempt:

- Passed the Registered Tax Return Preparer test (November 2011 — January 2013)

- Are an established participant of a state-based return preparer program (Oregon, California, and/or Maryland)

- Passed the Special Enrollment Exam Part I within the past two years

- VITA volunteer: Quality reviewers, instructors, and return preparers with active PTINs

- Have an accredited tax-focused credential from the Accreditation Council for Accountancy and Taxation’s Accredited Business Accountant/Advisor and Accredited Tax Preparer Programs

Exempt Tax Return Preparer Requirements

If the preparer meets one of the above requirements they are considered to be an exempt preparer and must meet the following requirements each year:

PTIN Education Requirements – Exempt Tax Return Preparers

- Complete a total of fifteen (15) hours of continuing education which must include:

- Three (3) hours of federal tax law updates

- Ten (10) hours of other federal tax law topics

- Two (2) hours of ethics

- Renew (or obtain) their PTIN

- Consent to adhere to specific practice obligations outlined in Circular 230, Section 10.51

Some of the benefits for a tax preparer who receives a Record of Completion are:

- Inclusion in the public database of return preparers on the IRS website

- Limited representation rights (This means that they will be able to represent clients whose returns they signed before revenue agents, customer service representatives, and similar IRS employees.)

It is important to note that beginning with the 2016 Filing Season, any unenrolled preparer who does not have a Record of Completion will not have any representation rights. This means that they will only be allowed to prepare and sign returns.

For more information on the IRS Annual Filing Season Program and Circular 230 see the following:

- Main Annual Filing Season Program page on the IRS website.

- General Requirements

- Chart of Annual Filing Season Program CE Requirements

- Circular 230

PTIN — What it is and IRS Requirements to Have One to Prepare Federal Income Tax Returns

PTIN Basic Information

- What is a PTIN? It is an eight-digit number preceded by the letter P that is issued by the IRS to paid tax return preparers

- PTIN number example — An example of a PTIN number is P01234567. The preparer will use this number (in place of their SSN) as their identification number on all federal income tax returns that they prepare for compensation. A PTIN is good January — December of each year. It must be renewed each year.

- What does PTIN stand for? PTIN stands for Preparer Identification Number

- Who must have a PTIN? Any individual who prepares or assists in preparing federal tax returns for compensation must have a valid PTIN before preparing returns.

- PTIN Renewal Fee – The fee to renew or obtain a new PTIN is currently $19.75 per year.

- How long does it take to obtain a PTIN? Most first-time applicants can obtain a PTIN online in about 15 minutes. If an individual prefers, they can file Form W-12 (IRS Paid Preparer Tax Identification Number (PTIN) Application on paper and send it to the IRS along with a payment of $19.75. It will take 4 — 6 weeks to receive their PTIN by mail.

- When can you renew or obtain a new PTIN each year? The IRS usually opens up for registering for a new or renewal of an existing PTIN for the upcoming calendar in late October. An individual may register for each calendar year beginning in October of the year before through September of the calendar year you are registering for.

- Is there an age requirement for obtaining a PTIN? Yes, applicants must be at least 18 years of age to obtain a PTIN.

PTIN Renewal

Here is what you need to know about renewing a PTIN.

Steps to Renew My PTIN

- Go to the IRS Tax Professional PTIN System page on the IRS website

- Log in to your account by entering your user ID and password

- Complete the online renewal application.

- Verify your personal information and answer all applicable questions

- Pay the $19.75 user fee

- Get your PTIN online

Items you will need to renew your PTIN

- Credit/Debit/ATM card for the $19.75 PTIN user fee

- If applicable, any US-based professional certification information (Enrolled Agent, CPA, Attorney, etc.) including certification number, jurisdiction of issuance and expiration date.

- Business information (name and mailing address)

- Personal information (name and mailing address)

PTIN Application

Here is what you need to know about obtaining a new PTIN.

How to Get a New PTIN

- Go to the IRS Tax Professional PTIN System page on the IRS website

- Click on New User

- Follow the prompts to set up your account

- Complete the online application

- Pay the $19.75 user fee

- Get your PTIN online

PTIN Application Checklist

- Social Security Number

- Personal information (name, mailing address, date of birth, email address)

- Previous year’s individual income tax return (Name, address and filing status used in filing the return)

- Credit/Debit/ATM card for the $19.75 PTIN user fee

- If applicable, any US-based professional certification information (Enrolled Agent, CPA, Attorney, etc.) including certification number, jurisdiction of issuance and expiration date

PTIN FAQ

- Do I need a PTIN to prepare taxes? Yes, any individual who prepares or assists in preparing federal tax returns for compensation must have a valid PTIN before preparing returns.

- How do I find my PTIN number? It is available in your account accessed through the IRS Tax Professional PTIN System. Once you have logged in you can see your PTIN on the first screen My PTIN Information. It also shows your PTIN status on this screen as well.

- What happens if you forget to renew your PTIN? Forgetting to renew your PTIN could result in the imposition of IRS Code Section 6695 penalties, injunctions, and/or disciplinary action by the IRS Office of Professional Responsibility.

- What kinds of felonies would affect your ability to get a Preparer Tax Identification Number? When applying for a PTIN, each individual must answer a question about whether they have been convicted of any felony in the past 10 years. If the answer is Yes, then they must provide an explanation and the IRS will determine on a case-by-case basis whether their felony conviction disqualifies them from obtaining a PTIN. Any felony related to tax fraud and other forms of financial crimes are typically not eligible for a PTIN. Also, any offenses that include deception or that demonstrate a refusal to recognize lawful authorities will also typically prevent an individual from obtaining a PTIN.

- What will prevent an individual from obtaining a PTIN? Individuals must be current in both their individual and business federal taxes, which includes any corporate or employment tax obligations. Individuals will also be ineligible to apply for a PTIN if they have been disbarred, suspended or disqualified from practice before the IRS.

- Is a PTIN public information? The PTIN number itself is not public information. However, a PTIN holders contact information is publicly available via the PTIN holder listing that can be accessed on the PTIN Information and Freedom of Information Act page on the IRS website. PTIN holders are not allowed to opt out of the disclosure of their contact information because Freedom of Information laws make the information public.

- Are there any testing or continuing education requirements in order to obtain or renew a PTIN? You do need to pass a test or take continuing education courses to obtain a PTIN. The IRS encourages anyone with a PTIN to take continuing education. Preparers also have the option to complete the IRS Annual Filing Season Program and be issued a Record of Completion from the IRS. For more details, see IRS Voluntary Continuing Education Program information on this page.

- EFIN vs PTIN – A PTIN is the number issued by the IRS to paid tax return preparers. It is used as the tax preparer’s identification number on any tax return that they prepared for compensation. The PTIN is required for all individuals who prepare or assists in preparing federal tax returns for compensation. An Electronic Filing Identification Number (EFIN) is a number issued by IRS to individuals or firms that have been approved as authorized e-file providers. The EFIN is necessary to file federal returns electronically.

Additional PTIN Resources

For more details see the following on the IRS website:

- PTIN Requirements for Tax Return Preparers

- Frequently Asked Questions: Do I Need a PTIN?

- Requirements for Tax Return Preparers: FAQs

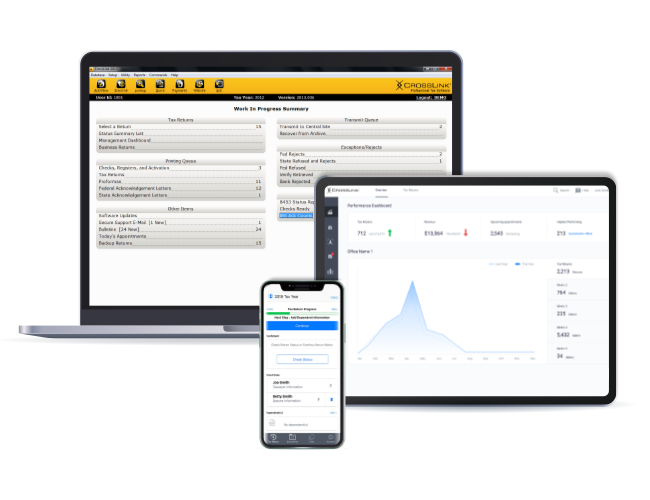

CrossLink Professional Tax Software

CrossLink is the industry’s leading professional tax software solution for high-volume tax businesses. Built based on the needs of busy tax offices and mobile tax preparers that specialize in providing their taxpayer clients with fast and accurate tax returns, CrossLink has been a trusted software solution since 1989. CrossLink’s in-depth tax calculations, advanced technological features, and paperless solutions allow you to prepare the most complicated tax returns with confidence and ease while providing your customers with an unparalleled experience.