The Tax Relief Act for American Families and Workers Act (HR 7024) successfully passed the House on January 31, 2024. It is currently awaiting consideration and potential voting by the Senate in the near future.

Upon Senate approval and subsequent presidential signing, the IRS will provide detailed guidance on the implications for 2023 tax returns that had previously claimed the additional child tax credit before the enactment of this legislation. Additionally, the IRS will communicate the timeline for updating its systems to accommodate the changes in the calculation of the additional child tax credit.

The IRS recommends early filing to ensure swift processing and to take advantage of any potential benefits under the revised child tax credit. “We urge and encourage taxpayers to file when they’re ready,” IRS Commissioner Danny Werfel told reporters Friday during a press call. “Don’t wait on Congress.” Furthermore, if adjustments are deemed necessary after the bill is enacted, the IRS pledges to efficiently calculate and issue a second check to qualifying individuals.

Key provisions in the House version of the legislation that directly impact individual taxpayers include:

Change to Child Tax Credit (2023-2025)

- Adjusts the calculation of the refundable additional child tax credit by multiplying an individual’s earned income exceeding $2,500 by 15% and then multiplying the result by the number of qualifying children. This would mean that the refundable portion of the credit would take into account each qualifying child.

- Increases the maximum refundable portion of the child tax credit to $1,800 for 2023, $1,900 for 2024, and $2,000 for 2025.

- Allows taxpayers to use the prior taxable year’s earned income for calculating the maximum additional child tax credit if the current year’s earned income is lower.

- Raises the maximum child tax credit to $2,100 for 2024 and 2025.

Legislation directs IRS to adjust any returns that claimed the additional child tax credit and send the refund to the affected taxpayers as expeditiously as possible.

Casualty Losses for Disaster Areas

Effective for federal disasters after December 19, 2019 through 60 days after the enactment of this legislation.

- Calculates the casualty loss as the loss less $500.

- Eliminates the 10% of Adjusted Gross Income (AGI) requirement for losses related to applicable federal disasters.

- Provides taxpayers the option to take the deductible loss as an itemized deduction or as an increase in the standard deduction.

Bonus Depreciation

- Extends 100% bonus depreciation for qualified property placed in service between December 31, 2022, and January 1, 2026.

- Allows 20% bonus depreciation for the calendar year 2026.

- Eliminates bonus depreciation for calendar years 2027 and beyond.

1099 Reporting Threshold (Effective 2024)

- Raises the information reporting threshold to $1,000 for payments made for services or sales of goods.

- The threshold amount will be indexed for inflation starting in 2025.

Employee Retention Credit

- Moves the deadline for claiming the employee retention credit for tax years 2020 and/or 2021 to January 31, 2024 (previously April 15, 2025).

- Increases penalties for individuals or organizations encouraging false claims of the Employee Retention Credit.

The article will be updated as developments unfold in the Senate, and if the bill successfully passes Congress and receives the President’s approval. This will include information on when the IRS will be prepared to process returns under the new child tax credit calculation and the procedures for handling returns filed before the legislation became law.

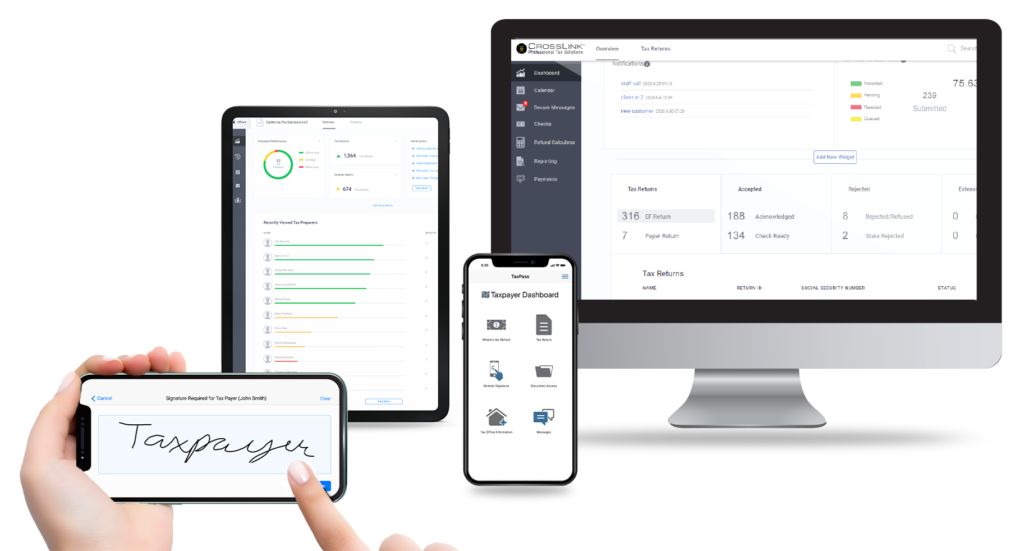

CrossLink Professional Tax Solutions

CrossLink is the industry’s leading professional tax software solution for high-volume tax businesses. Built based on the needs of busy tax offices and mobile tax preparers that specialize in providing their taxpayer clients with fast and accurate tax returns, CrossLink has been a trusted software solution since 1989. CrossLink’s in-depth tax calculations, advanced technological features, and paperless solutions allow you to prepare the most complicated tax returns with confidence and ease while providing your customers with an unparalleled experience.