PTIN Renewal is Available Now for 2024

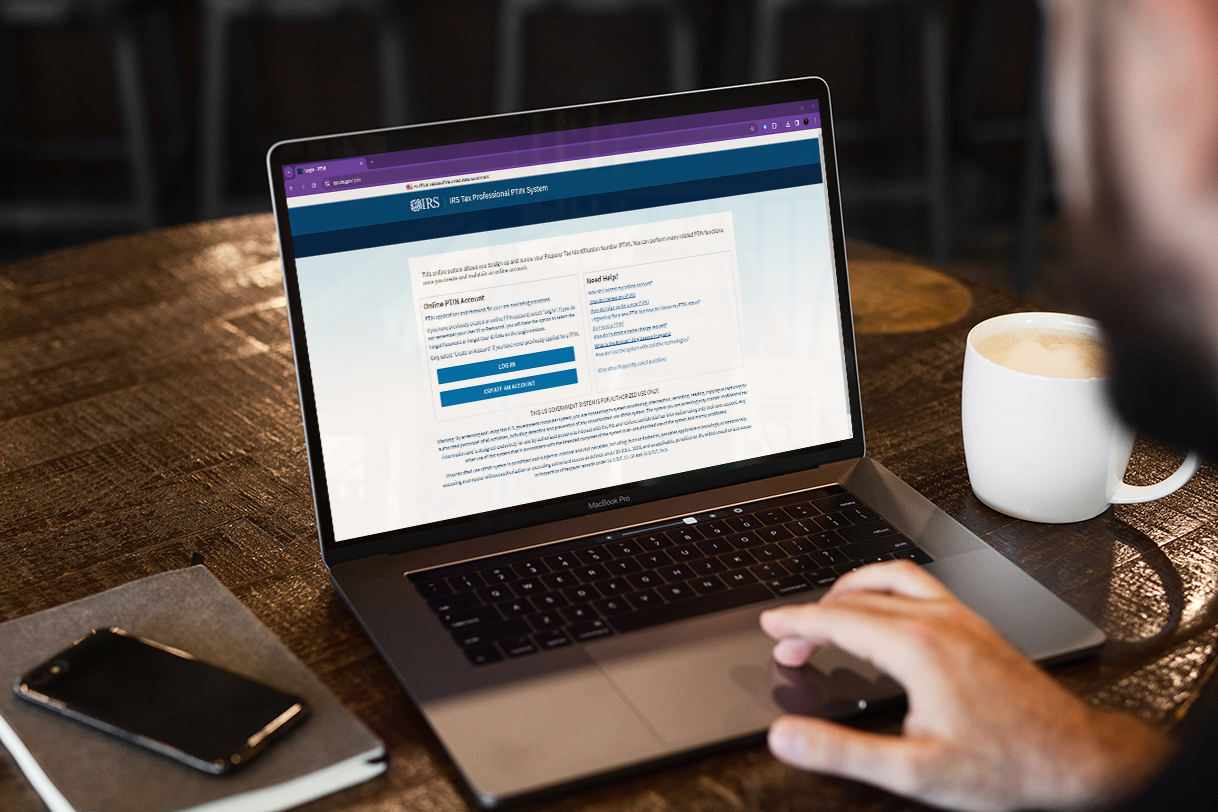

Tax preparers may now renew their PTIN for 2024 by going to the IRS Tax Professional PTIN System page on the IRS website.

PTIN Requirements to Remember

- Anyone who prepares a federal tax return for compensation must have a valid PTIN. Failure to have a valid PTIN may result in penalties.

- Fee for renewing or obtaining a PTIN is $19.75.

- All tax return preparers that currently have a PTIN must renew their PTIN for 2024 as all current PTINs for 2023 expire at the end of this year (December 31, 2023).

For more information see the following on the IRS website:

CrossLink Professional Tax Solutions

CrossLink is the industry’s leading professional tax software solution for high-volume tax businesses. Built based on the needs of busy tax offices and mobile tax preparers that specialize in providing their taxpayer clients with fast and accurate tax returns, CrossLink has been a trusted software solution since 1989. CrossLink’s in-depth tax calculations, advanced technological features, and paperless solutions allow you to prepare the most complicated tax returns with confidence and ease while providing your customers with an unparalleled experience.