A business income tax return is a crucial document that sole proprietors, corporations, partnerships, and limited liability companies must file each year. This guide aims to provide tax preparers who primarily file individual tax returns with the knowledge and tools to expand their services to include business tax return preparation.

Importance of Offering Business Tax Return Services for Tax Professionals

For tax preparers who specialize in individual tax returns, expanding into business tax return services can open up new opportunities for growth and revenue. By offering these services, tax professionals can attract a wider range of clients, including small business owners and entrepreneurs. Additionally, helping businesses navigate complex tax laws and maximize deductions can establish tax preparers as trusted advisors, leading to long-term client partnerships and referrals.

Exploring Different Types of Business Income Tax Returns

Business income tax returns are essential for financial planning, compliance, and decision-making. They provide a clear picture of a business’s financial health and ensure accurate reporting to tax authorities.

Sole Proprietorship:

- An unincorporated business owned by a single individual.

- The owner receives all profits, is liable for all debts and losses, and pays personal income tax on business profits.

C Corporation:

- Formed by filing articles of incorporation with a state.

- A separate legal entity from its owners (shareholders).

- Shareholders profit through dividends and stock appreciation, with no personal liability for the corporation’s debts.

S Corporation:

- Elects to pass corporate income, losses, deductions, and credits through to shareholders for federal income tax purposes.

- Must have no more than 100 shareholders, be a domestic corporation, have only one class of stock, and shareholders may only be individuals or certain trusts or estates.

Partnership:

- An unincorporated business formed by two or more individuals agreeing to manage and operate the business and share profits.

- Types of partnerships:

- General Partnership: All partners share legal, financial liability, and profits equally, with personal responsibility for partnership debts.

- Limited Liability Partnership: Limits partners’ personal liability, common among professionals like accountants and lawyers.

- Limited Partnership: Includes at least one general partner with full personal liability and partners whose liability is limited to their investment.

Limited Liability Company (LLC):

- A business structure in the United States that protects owners from personal responsibility for business debts and liabilities.

- Allowed by state statute, with owners called members (individuals, corporations, or other LLCs).

- Tax treatment depends on the number of members and elections made:

- With at least two members, treated as a partnership unless it elects to be treated as a corporation by filing Form 8832 (Entity Classification Election).

- With a single member, treated as a sole proprietorship unless it elects to be treated as a corporation by filing Form 8832 (Entity Classification Election).

How to File a Business Tax Return

Gathering necessary documentation:

Corporations, S Corporations and Partnerships will need the following to file their business income tax return each year:

- Year-end balance sheet and income (profit & loss) statement

- Year-end bank account and investment account statements

- Employer’s annual wage report and transmittal form (W-3)

- All payroll tax forms for the year which includes their Forms 940, 941 and state related withholding and unemployment forms.

- Records for business use of vehicles

- Records for purchases of business assets during the year such as equipment, vehicles, etc.

Sole proprietorships will need the following to file their Schedule C each year:

- Year-end bank account statement

- List of income and expenses with receipts and sales records

- Record for business use of vehicles

- Records of purchases of business assets during the year such as equipment, vehicles, etc.

- Copies of Form 1099-NECs/1099Miscs/1099-Ks received

- If they have employees – all payroll tax forms for the year which includes Forms 940, 941, and state related withholding and unemployment forms

Choosing the right forms:

- Sole Proprietor: Schedule C or Schedule F

- C Corporation: Form 1120

- S Corporation: Form 1120-S

- Partnership: Form 1065

Common mistakes to avoid:

- Underpaying estimated taxes

- Filing late

- Not separating business and personal expenses

- Keeping poor records

Timing and Deadlines for Filing Business Income Tax Returns

- March 15: S Corporation, Partnership (extension available until September 15)

- April 15: C Corporation (extension available until October 15), Sole Proprietor’s Individual Form 1040 (extension available until October 15)

- C Corporations and Sole Proprietors must file and pay estimated taxes each quarter of the year as follows:

- 1st Quarter – April 15

- 2nd Quarter – June 15

- 3rd Quarter – September 15

- 4th Quarter – January 15

If C Corporations and Sole Proprietors do not pay quarterly estimated taxes during the year then they will be penalized when they file their income tax return if they owe taxes.

C Corporations must pay their estimated payments via the Electronic Federal Tax Payment System (EFTPS).

Sole Proprietors must pay their estimated payments by mailing Form 1040-ES with their payment to the IRS or use IRS Direct Pay via the IRS website.

Consequences of Missing Deadlines or Underpaying

Failure to File Penalty

- 5% of the unpaid taxes for each month or part of a month the tax return is late up to a maximum of 25% of the unpaid taxes.

- If the return is more than 60 days late, the minimum Failure to File penalty is $485 or 100% of the unpaid tax, whichever is less.

Failure to Pay Penalty

- 0.5% of the unpaid taxes for each month or part of a month the tax remains unpaid up to a maximum of 25%.

- If IRS sends an intent to levy notice, the failure to pay penalty is 1% per month.

- If the individual has set up an approved payment plan, the failure to pay penalty is reduced to .25% per month.

Underpayment of Estimated Tax Penalty

- If sole proprietor or corporation does not pay enough to cover their tax for the year, they may have to pay an underpayment penalty.

- Most taxpayers will avoid the penalty if the tax they owe is less than $1,000 or they paid at least 90% or the tax for the current year or 100% of the tax shown on the return for the prior year.

- The underpayment of estimated tax penalty is calculated per quarter and the percentage varies each year and may vary by quarter as well.

Expanding your tax preparation business to include business tax return services can be a strategic move to grow your client base and increase revenue. By offering comprehensive tax services to businesses, you can position yourself as a trusted advisor and enhance your professional reputation. Consider the benefits of diversifying your services and tapping into the lucrative market of business tax preparation.

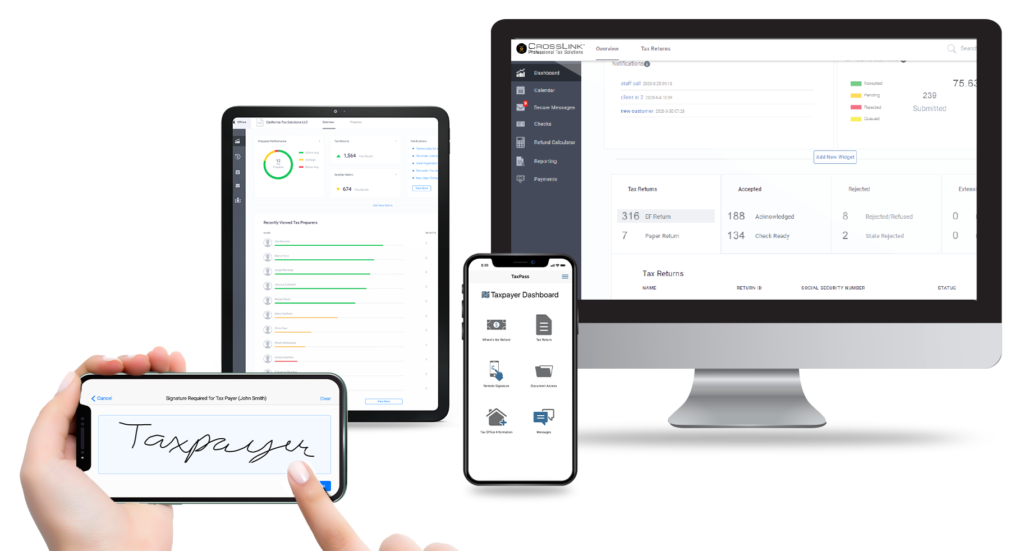

For tax preparers looking to expand their services and grow their tax preparation business, consider offering business tax return services with CrossLink Business tax software. With user-friendly features and comprehensive support, CrossLink Business can help you streamline the process of filing business tax returns and attract new clients. Reach out today.

CrossLink Professional Tax Solutions

CrossLink is the industry’s leading professional tax software solution for high-volume tax businesses. Built based on the needs of busy tax offices and mobile tax preparers that specialize in providing their taxpayer clients with fast and accurate tax returns, CrossLink has been a trusted software solution since 1989. CrossLink’s in-depth tax calculations, advanced technological features, and paperless solutions allow you to prepare the most complicated tax returns with confidence and ease while providing your customers with an unparalleled experience.