CrossLink Franchise

What is a Tax Franchise?

A tax franchise is a business that sells the right to use its name and business system to sell or distribute its products and/or services to an individual franchisee. Tax franchises focus on selling to Electronic Return Originators (EROs) and professional tax preparation businesses under their own brand. By doing this, franchises are able to grow their business while independent tax professionals are able to own and operate their own tax preparation office while also gaining the benefits of the franchise’s experience, brand recognition, training, marketing, and other resources. In addition to these benefits, a tax franchisee typically enters into a multi-year partnership agreement with the tax franchisor, providing stability for their tax business.

If you already run a tax franchise and are interested in switching tax software providers, or if you are a successful service bureau looking to expand your business model further, become a partner with CrossLink and discover how our industry-leading software and services can help your franchise enterprise achieve the ultimate level of success.

CrossLink Software

CrossLink provides service bureaus the industry’s best professional tax software and solutions to bolster their product and service offerings for their customers. Provide your EROs with industry-leading online and desktop tax software that is fast, simple, and straight-forward.

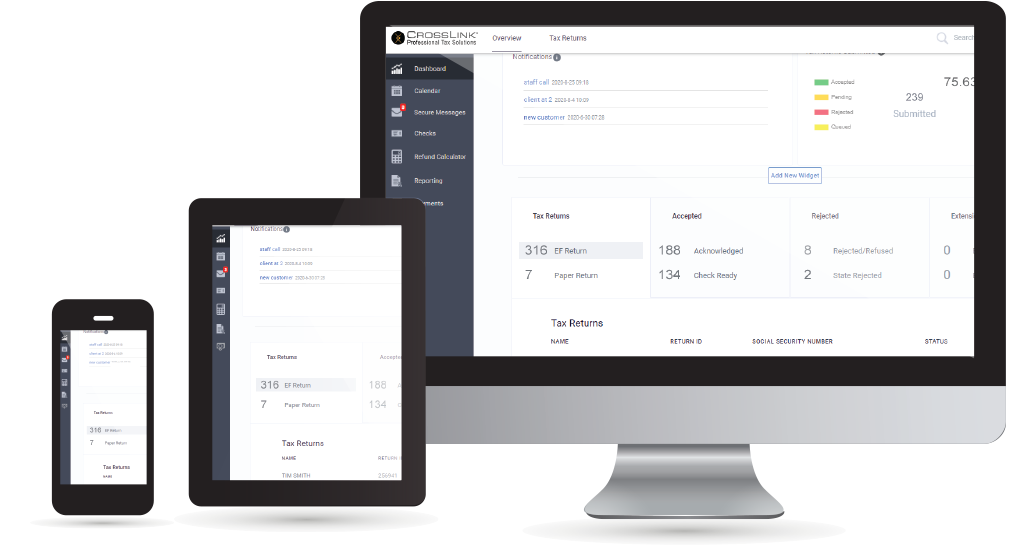

CrossLink Online

Simple enough for brand-new preparers, yet powerful enough for the most complex service bureau environments — CrossLink Online is built with your unique business in mind.

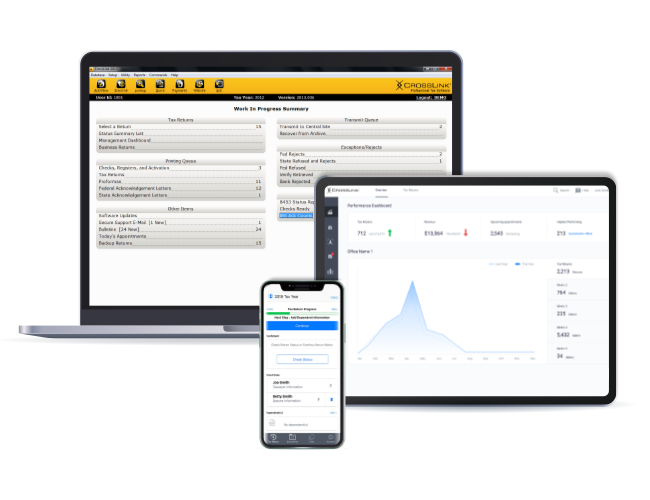

CrossLink 1040 Desktop

A trusted solution since 1989, CrossLink 1040 is the industry’s best desktop professional tax software for high-volume tax businesses. With features like our Mobile Apps and Management Dashboard that put control and oversight of your offices at your fingertips, you can manage your service bureau business the way you want.

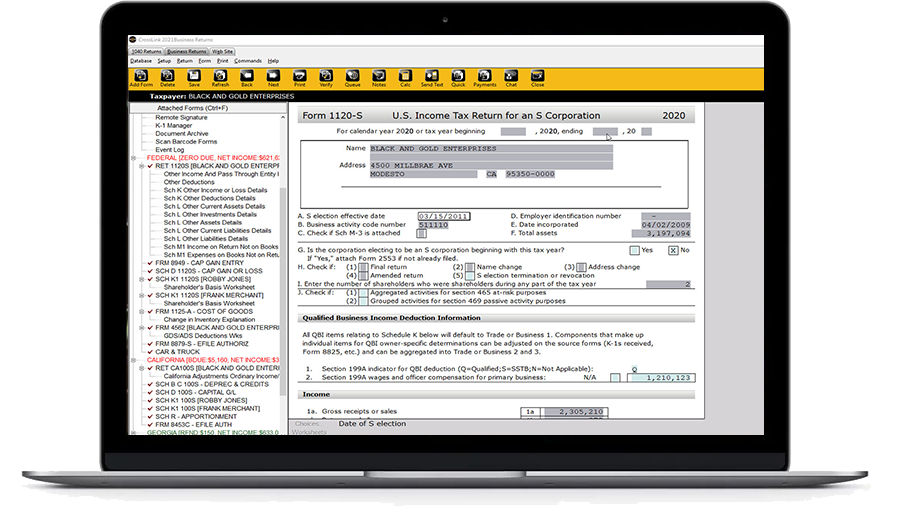

CrossLink Business

A complete solution for professional tax preparers who prepare Federal and State business tax returns. CrossLink Business is 100% integrated with — and comes with all the same features users love about — CrossLink 1040 Desktop, including:

- Management Dashboard

- Point-and-Shoot Error Correction™

- Electronic Signature and Scan & Store

Benefits of a Tax Software Franchise

Being a tax franchise allows you to make additional revenue from selling the right for other tax businesses to use your established brand and business model. Franchising your tax business also allows you to rapidly grow your brand and expand into markets you may not have been able to since the franchisee brings the money needed to open a new tax office.

In addition to the revenue made from selling a franchisee the rights to use your brand and business model, tax franchises are able to generate revenue year-round while creating new income streams from products and services such as:

- Tax software

- eFiles

- Bank Products

- Technical Support

- And more...

As a tax franchise partner with CrossLink, you also have the option to co-brand the software, online or desktop, with your logo to provide your tax franchisees with your own fully branded experience. Get all this without the need to design, program, and maintain a complex tax software program on your own.

CrossLink Tax Software Franchise Requirements

Ready to make CrossLink the tax software provider of your tax franchise? Contact the CrossLink Team at 800.345.4337 or by clicking the button below.