2024 Tax Inflation Adjustments

The IRS announced their annual inflation adjustments for over 60 tax provisions in tax year 2024, including increases in the standard deduction and maximum EITC.

Latest Requirements for States with Their Own Earned Income Tax Credit and Child Tax Credit

Thirty states and the District of Columbia have enacted their own version of the federal Earned Income Tax Credit (EITC). The details of each state EITC requirements are explained below.

Also, six states have enacted their own version of the federal Child Tax Credit. Of these six states, all but one also has an EITC. The details for each state are explained below.

Employee Retention Credit

Over the past few months, you may have seen information in the media about the Employee Retention Credit and the most recent news that the IRS has stopped processing any new claims for this credit due to the high incidence of questionable claims being submitted to the IRS.

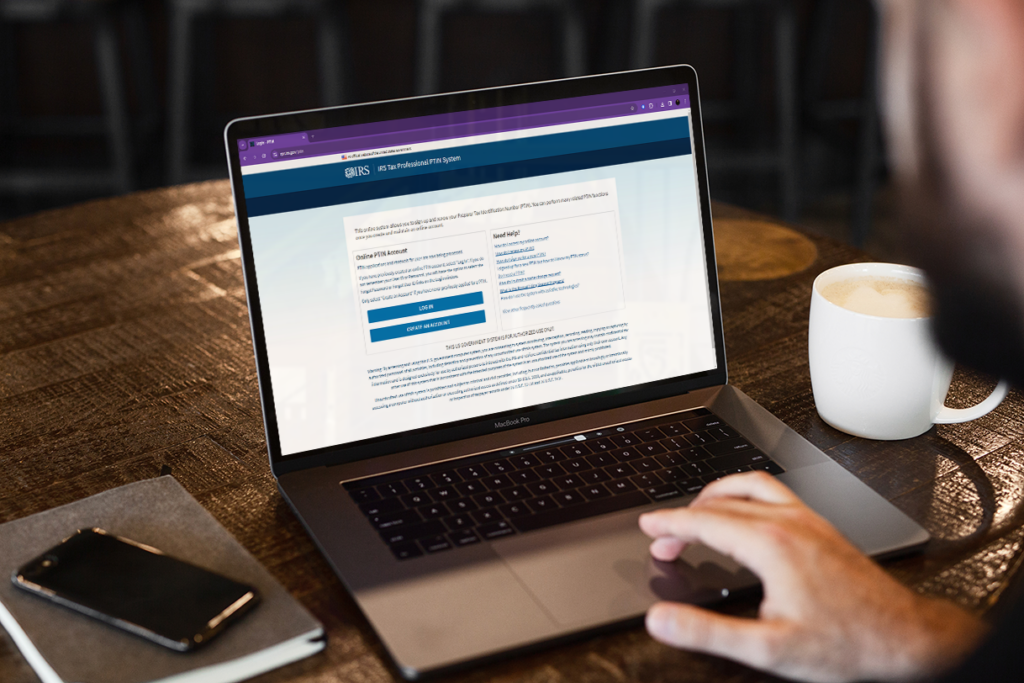

2024 PTIN Renewal is Now Open

Tax preparers may now renew their PTIN for 2024 by going to the IRS Tax Professional PTIN System page on the IRS website.

IRS Voluntary Continuing Education Program and PTIN Requirement for Federal Tax Return Preparers

This page is designed to help you understand PTINs and the IRS requirement to have one and renew it each year, as well as the IRS Voluntary Education Program.

IRS Direct File Pilot Program

On October 17, 2023, the IRS announced more details on the new IRS Direct File Pilot which will be introduced during the upcoming 2024 filing season.

2023 Energy Efficient Home Improvement Credit

Energy Efficient Home Improvement Credit Included in the Inflation Reduction Act of 2022 was the Energy Efficient Home Improvement Credit (formerly known as the Nonbusiness Energy Property Credit). Is the […]

2023 Used and Commercial Clean Vehicle Credits

Used and Commercial Clean Vehicle Credits The Inflation Reduction Act included two new credits for clean vehicles. They are the Credit for Previously Owned Clean Vehicles and the Commercial Clean […]

2023 Residential Clean Energy Credit

The Inflation Reduction Act of 2022 extended and increased the Residential Energy Credit and renamed it the Residential Clean Energy Credit.

2023 IRS Security Summit

This year’s Security Summit tax professional summer campaign is emphasizing the following series of simple actions that they can take to better protect their clients and themselves from sensitive data theft.