Purchase CrossLink Desktop or CrossLink Online software for the 2025 Tax Season by April 30, 2024 and get automatically entered into the drawing.

Professional Tax Software

WE BELIEVE... in building a product you need.

Every year we take hundreds of customer suggestions and work them into our software — because you know the needs of your community better than anyone else. Our job is to support your success.

Dedicated Account Teams

Pre-Season Software Training

Multi-Lingual Technical Support

WE ALSO BELIEVE... in business fundamentals and helping you increase your revenue.

Financial Products

Industry Leading Rebates

Ancillary Product Offerings

STAY INFORMED

WITH CROSSLINK

Latest Tax Updates

2024 IRS Dirty Dozen Tax Scams

Safeguarding Tax Professionals: Watch Out for Tax Season Scams

Online Product & Training Videos

Access instructional product videos and online training for the CrossLink Suite of professional tax preparation products and solutions.

Access instructional product videos and online training for the CrossLink Suite of professional tax preparation products and solutions.

Tax Resource Center

Access instructional product videos and online training for the CrossLink Suite of professional tax preparation products and solutions.

Access instructional product videos and online training for the CrossLink Suite of professional tax preparation products and solutions.

A partner for entrepreneurs like you...

Professional Tax Solutions

We believe in building a product you need. Every year, we take hundreds of customer suggestions and work them into our software because you know the needs of your community and your business better than anyone else. With industry-leading tools such as Point-and-Shoot Error Correction™, exclusive TextLink™ integrated text messaging technology, and support for electronic signature pads and hand-held W-2 barcode scanners, CrossLink 1040 software users are able to process tax returns more quickly and accurately.

Solutions to Grow with Your Business

Single Tax Office

With both desktop and online solutions, CrossLink has the tools to ensure the success of your business while serving the needs of your community.

Multiple Tax Offices

As your business grows, so do your needs — and our products are designed to grow with you. This ensures a consistency that your business needs to successfully expand.

Franchises

CrossLink has a successful history helping local and national franchises compete with large corporations.

Service Bureaus

As the leading tax solution for Service Bureaus, CrossLink understands the unique needs of this market.

Tax software inspired and improved by the feedback of our users. Fast, simple, straight-forward... online or desktop.

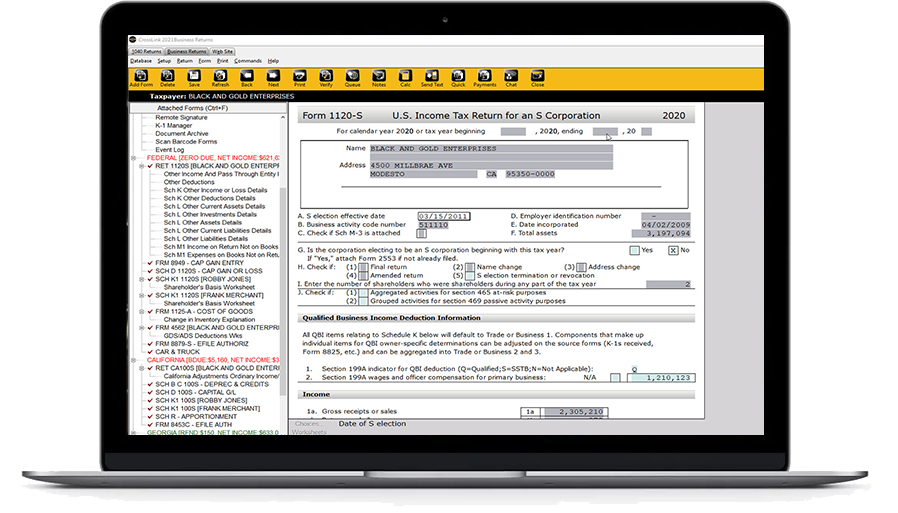

CrossLink 1040 Desktop

A trusted solution since 1989, CrossLink 1040 is the industry’s best professional tax software for high-volume tax businesses.

CrossLink Online

A powerful online professional tax solution that scales with your business

Simple enough for brand-new preparers, yet powerful enough for the most complex service bureau environments — CrossLink Online is built with your unique business in mind.

- Traditional tax offices

- Mobile tax offices

- Growing tax businesses

- Multi-office businesses

- Nationwide Service Bureaus

CrossLink Business

A complete solution for professional tax preparers who prepare Federal and State business tax returns. CrossLink Business is 100% integrated with – and comes with all the same features users love about – CrossLink 1040 Desktop, including:

- Management Dashboard

- Point-and-Shoot Error CorrectionTM

- Electronic Signature and Scan & Store Support